Lithium mineral

Critical and strategic raw materials

There is a great demand for metals and minerals in today´s society. In Europe, we consume about a quarter of the world´s raw materials but produce only three percent. This means a large dependency on imports. According to the EU, European production of raw materials needs to increase.

The EU has listed 34 minerals and metals as critical and/or of strategic importance for European society and welfare. These critical raw materials (CRMs) constitute ingredients in key technologies necessary for securing the green transition, digitalisation, space industry and defence capabilities. They are critical because of their economic importance in relation to the risk of supply interruption (the supply risk). Read more about the different raw materials on our web pages.

The latest list, which was determined in 2023, also includes a group of 16 so-called strategic raw materials (SRMs) of even greater priority. Two metals in this group are not classified as critical, only as strategic: copper and nickel. Their global production is sufficiently diversified not to have a high supply risk, but they are considered to be so fundamental, above all for electrification, as to be included in the strategic classification.

The EU highlights four crucial areas with regards to raw materials:

- robust value chains for EU industry

- reduced dependency on primary raw materials through an enhanced circular economy

- increased production and processing of raw materials within the EU

- diversified supply through sustainable international trade

The table below shows raw materials classified as critical by the EU. Bold typescript indicates that the material is new on the list. Yellow shading indicates raw materials of strategic importance.

|

aluminium/bauxite |

antimony |

arsenic |

|

baryte |

beryllium |

bor/borate |

|

flourspat |

phosphate rock |

phosphorus |

| feldspar | gallium |

germanium |

|

natural graphite |

hafnium |

helium |

|

rare earth elements: HREE and LREE |

silicon metal |

cobalt |

|

coking coal |

copper* |

lithium |

|

magnesium |

manganese |

nickel* |

|

niobium |

platinum group metals: PGM |

scandium |

|

strontium |

tantalum |

titanium |

|

vanadium |

bismuth |

tungsten |

*=Strategic but not critical raw material

A major part of the production of critical raw materials takes place outside the EU. There are, however, a significant number of known deposits of critical minerals and metals within the EU, Sweden included. In Sweden there are known deposits of antimony, fluorite, phosphate minerals, graphite, cobalt, metals of the platinum group (PGM), rare earth elements (REE), bismuth and tungsten. Significant and well described Swedish mineralisations include phosphate minerals, fluorite, graphite and REE.

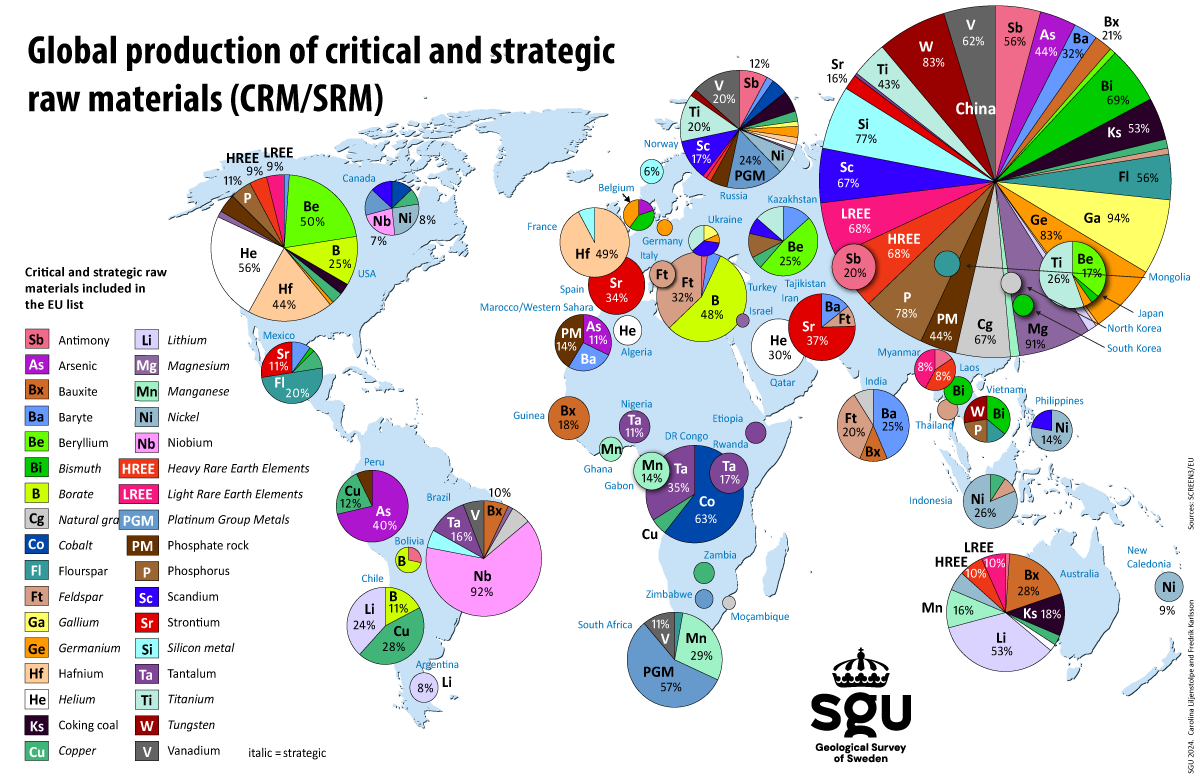

The map below shows the global distribution of the production of various critical raw materials. Click on the map to open it in a larger window. The map can also be downloaded in pdf format.

How to read the map

Each circle shows estimates of each country's average production of various critical minerals and metals between the years 2016 and 2020, calculated on a percentage by weight basis. Production refers to primary production, which in most cases corresponds to ore or concentrate. In some cases, the metal content of some form of refined product is instead reported due to a lack of reliable statistics. The percentages printed for the various materials show its share of world production (the combined areas of the "pie pieces" for a particular raw material add up to 100 percent, still based on weight). For example, Brazil accounts for 92 percent of the world's production of niobium. The map shows, among other things, that China completely dominates the total production, even if they do not produce all critical raw materials. Please note that this map applies to critical and strategic raw materials. That is why, for example, Sweden is not included, which is otherwise a major producer within the EU of iron ore, precious metals and base metals.

Source: SCRREEN2/EU.

EU legislation on Critical Raw Materials

The European Commission has taken initiatives to make the EU more self-sufficient in critical raw materials. The Critical Raw Materials Act was published in March 2023 and entered into force as an EU regulation on 23 May 2024. It contains proposals for legislation promoting raw materials production and calls for member states to increase mapping, research and innovation. The Raw Materials Act will be implemented step by step in Swedish legislation.

China is the largest producer

China is the largest producer of most of the critical raw materials, e.g. the rare earth elements, magnesium, tungsten, antimony, gallium and germanium.

Several other countries have a leading position in the production of specific raw materials, such as Brazil (niobium) and the United States (beryllium and helium). The production of the platinum group metals is concentrated in Russia (palladium) and South Africa (iridium, platinum, rhodium and ruthenium).

Reasons why the supply of several materials is considered critical include that the production of the substance in question is geographically concentrated in one or a few countries, often with governance issues, while the potential for recycling and/or substitution of the same substance is low or non-existent.

Rapidly increasing demand

Global trends and tendencies clearly show that the demand for many of the critical materials will increase dramatically in the near future. The new energy technologies such as those found in solar cells, electricity networks and biofuels are forecast to require large amounts of, for example, rare earth elements (REE), cobalt and ruthenium.

In order to produce so-called permanent magnets, which are mainly used in wind turbines and electric vehicles, neodymium (Nd), dysprosium (Dy) and praseodymium (Pr) are necessary; all three are examples of rare earth elements. The demand for these is estimated to increase by some 250 percent during 2020–2030. The case of electric vehicle production is just one example; magnet materials are critical for the manufacture of the electric traction engines – an additional 1 – 2 kilograms are required compared to conventional car production. The increasing demand is reflected in the price trends; the price of neodymium and praseodymium, for example, increased by some 60 percent during the period July to September 2017.

In 2017, some 4 million electric vehicles were sold. By 2030 sales will, according to forecasts, have risen to some 50 million vehicles per year. This means that increasingly large amounts of rare earth elements need to be extracted in order to obtain sufficient amounts of neodymium and praseodymium and others. The same trend applies to several other critical metals, including lithium and cobalt.

Increased mining in Europe required

It is projected that it will take at least until 2100 before recycling can account for 50 percent or more of the rare earth elements that will be required in Europe and the world at the turn of the century. Alternatives are needed. According to the European Commission, the most secure and realistic alternative from a supply perspective is increased mining in Europe of a number of the critical and strategic metals. European mining can gradually secure the supply of certain critical minerals and metals while limiting the present uncertain dependency on imports from non-democratic states, and from countries practising unethical and illegal extraction.

Last reviewed 2024-09-17